- Guides

Leveraging CEX Inflow and Outflow Data for Your Alpha Research

- 2 weeks

Contents

ToggleCentralized Exchanges (CEXs) wield immense power within the crypto ecosystem. Any market updates or news about them can send shockwaves through the crypto world, impacting prices and sentiment. As both the front door for newcomers to crypto and the exit point for those leaving, their influence cannot be overstated. Neglecting to track token movements in and out of CEXs can spell trouble for your investment strategies.

In this blog, we’ll delve deep into the world of CEXs, exploring how monitoring inflow and outflow data can be your compass in the world of crypto, guiding you toward profitable opportunities and top alpha hunting.

Contents

ToggleWhat is a CEX?

CEX stands for Centralized Exchange. These are online platforms that serve as intermediaries for users to buy, sell and trade cryptocurrencies with their fiat currencies. Unlike Decentralized Exchanges (DEXs), which operate without a central authority, CEXs are run by centralized organizations. They offer a user-friendly interface, high liquidity, and a wide variety of cryptocurrencies for trading. Some well-known CEXs include Binance, Coinbase, Kraken, and Bitfinex.

CEX vs. DEX: What Sets Them Apart?

Understanding the difference between CEXs and DEXs is crucial in crypto:

CEX (Centralized Exchange):

- – Operated by centralized organizations.

- – Offers a user-friendly interface.

- – High liquidity due to a large user base.

- – Typically involves not having complete control of your assets as user deposits are held by the exchange.

- – Examples: Binance, Coinbase, Kraken.

DEX (Decentralized Exchange):

- – Operates without a central authority.

- – Uses blockchain technology and smart contracts for trading.

- – Users retain control of their private keys and funds.

- – Liquidity can be lower than CEXs.

- – Examples: Uniswap, SushiSwap, PancakeSwap

Common Flow of Transactions in Crypto

In crypto, transactions often follow a common pattern:

- Putting Fiat into CEX: Many users start by depositing fiat currency (like USD or EUR) into a CEX. This fiat is then used to buy cryptocurrencies.

- Buying Crypto and Moving to DEX: After acquiring cryptocurrencies on the CEX, some users transfer their assets to a Decentralized Exchange (DEX) for trading or investment purposes. DEXs provide access to a wide range of tokens and allow users to participate in decentralized finance (DeFi) projects.

- Bringing Crypto Back to CEX: At times, users may return their cryptocurrencies to the CEX to sell them for fiat currency or to exit the cryptocurrency ecosystem altogether. This is often done when they want to convert their crypto gains into traditional currency.

Understanding CEX Inflow and Outflow Data

1. CEX Inflow Data:

- – What It Signifies: CEX inflow data indicates that cryptocurrencies are being moved back into centralized exchanges. This movement is typically associated with the intention to sell the crypto for fiat currency, signalling a bearish sentiment. Investors and traders might be exiting the crypto ecosystem, and capital is flowing out of crypto.

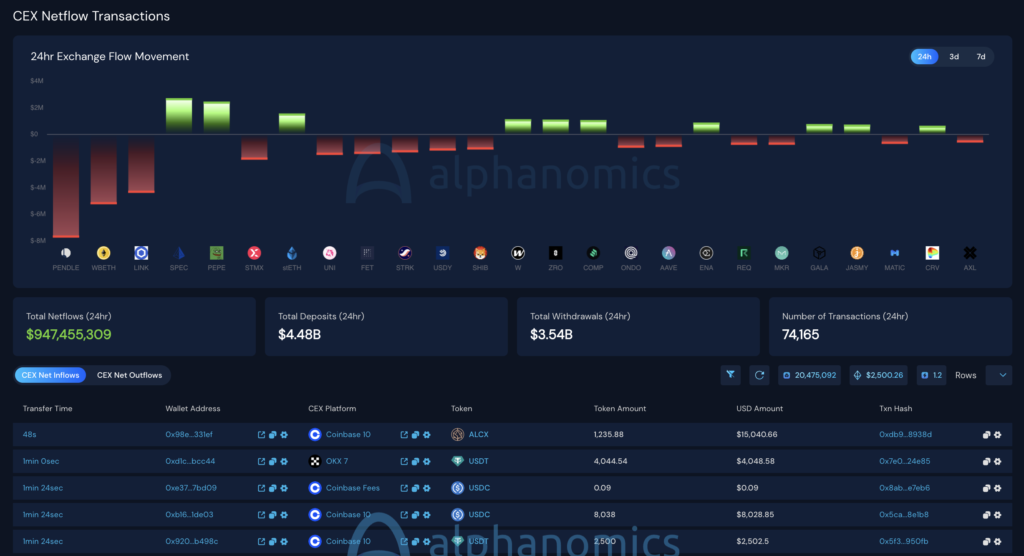

- – Using Alphanomics: Alphanomics offers a “CEX Net Inflow” tab that lists the top tokens with the highest CEX inflow over different time intervals (e.g., 10 minutes, 1 hour, 6 hours, 1 day) along with their corresponding trading volumes. This data can help you identify tokens that are likely to be sold off, indicating bearish sentiment. You can adjust your investment strategy accordingly by considering the potential for price declines in these tokens.

2. CEX Outflow Data:

- – What It Signifies: CEX outflow data reveals that fiat currency is being converted into crypto and moved out of centralized exchanges. This movement usually signifies a bullish sentiment, indicating that individuals are entering the crypto ecosystem, and capital is flowing into crypto assets.

- – Using Alphanomics: Alphanomics provides a “CEX Net Outflow” tab that showcases the top tokens with the highest CEX outflows over different time intervals. This data can help you identify tokens that are currently experiencing bullish sentiment, with people buying them on CEXs and moving them into cold storage or for use within the crypto ecosystem. Such insights can inform your investment thesis, potentially leading you to consider these tokens for investment or further research.

Alphanomics also offers another impressive feature – the CEX Inflow/Outflow transactions stream. With this tool, users gain real-time access to a wealth of transaction information associated to CEXs, including:

- – Timestamp of the transfer

- – The tokens being sent

- – Transaction price and quantity

- – Wallet addresses involved in both sending and receiving

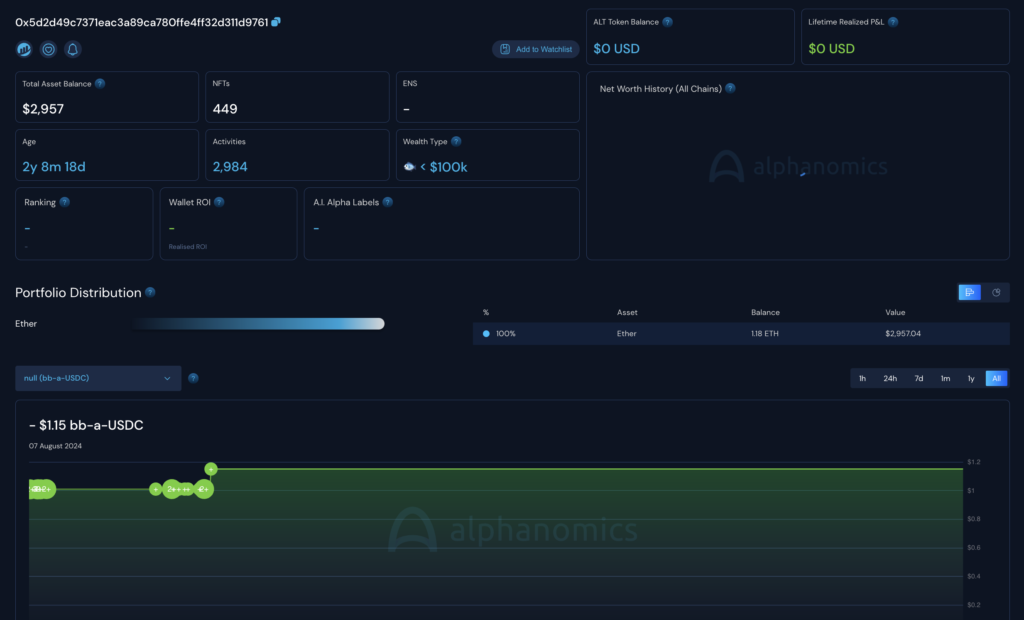

If any particular transaction piques your interest, you can quickly explore it further by investigating the wallets associated using the Wallet Deep Explorer feature on Alphanomics or investigate the tokens that are being transferred using the Token Genius on Alphanomics.

Add Massive Edge To Your Research

CEX inflow and outflow data are invaluable tools for crypto investors looking to gain a competitive edge in a rapidly changing market. By monitoring these metrics, you can gauge market sentiment, identify potential investment opportunities, and adapt your strategy accordingly. Remember that the crypto market is highly volatile, and successful investment requires a comprehensive approach to analysis, including the use of data like CEX inflow and outflow to inform your decisions.

To supercharge your on-chain analysis and uncover the next top crypto investment, add Alphanomics to your research stack and 10x your output. We simplify the process by providing real-time insights and visual representations of critical data. Sign up today!